Using an Offshore Trust for International Asset Diversification

Wiki Article

Discover Exactly How an Offshore Trust Can Boost Your Estate Preparation Strategy

If you're seeking to reinforce your estate preparation strategy, an offshore Trust might be the option you require. These depends on supply one-of-a-kind advantages that can safeguard your assets while providing tax and privacy advantages. However, lots of people have misunderstandings regarding exactly how they work and their significance. Recognizing these components can be crucial for your economic future. Allow's discover what an offshore Trust can do for you.

Recognizing Offshore Depends On: What They Are and Exactly How They Work

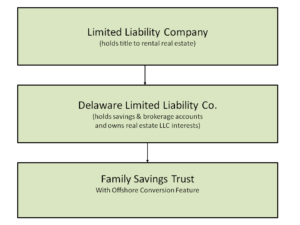

Offshore trusts are effective monetary tools that can help you handle your possessions while offering benefits like personal privacy and tax advantages. Primarily, an overseas Trust is a lawful setup where you move your properties to a depend on established in an international territory. This arrangement enables you to separate possession from control, suggesting you don't straight have the assets any longer; the Trust does.You'll select a trustee to take care of the Trust, ensuring your possessions are dealt with according to your wishes. This setup usually secures your assets from creditors and lawful claims, as they're kept in a various lawful system. Furthermore, you can specify just how and when beneficiaries obtain their inheritance, adding a layer of control to your estate preparation. By recognizing exactly how offshore trusts work, you can make informed decisions that line up with your financial goals and supply comfort for your family members's future.

Key Benefits of Offshore Trust Funds for Asset Defense

While you may not constantly have the ability to anticipate monetary obstacles, developing an offshore Trust can be an aggressive step toward securing your assets. One crucial advantage is the included layer of safety and security it provides against financial institutions and lawful judgments. By putting your possessions in an overseas Trust, you create an obstacle that makes it harder for prospective plaintiffs to reach your riches.Additionally, overseas depends on can assist you protect your assets from economic or political instability in your house nation. This geographical splitting up assurances that your wide range remains protected, even if your domestic circumstance adjustments suddenly.

An additional advantage is the capacity for privacy. Several overseas territories permit greater privacy, making it tough for others to uncover your monetary holdings. This discretion can hinder unimportant legal actions and unwanted attention. Overall, an offshore Trust can be an effective device in your property defense approach, offering you comfort.

Tax Obligation Advantages of Developing an Offshore Trust

When you establish an overseas Trust, you not just boost your asset defense however additionally reveal beneficial tax deferral chances. This can substantially lower your taxed earnings and help your wealth expand in time. Recognizing these benefits can be a game-changer in your estate planning technique.Asset Defense Perks

Establishing an overseas Trust can significantly enhance your property security strategy, specifically if you're aiming to shield your riches from creditors and lawful judgments. By putting your properties in a depend on, you efficiently divide them from your personal estate, making it harder for creditors to access them. This included layer of protection can hinder suits and provide tranquility of mind.Moreover, several offshore territories have robust personal privacy laws, guaranteeing your financial events remain private. In case of lawful disputes, having properties held in an overseas Trust can complicate efforts to seize those possessions, as it's more difficult for financial institutions to navigate international regulations. Eventually, an offshore Trust is an effective tool in protecting your riches for future generations.

Tax Obligation Deferment Opportunities

Offshore trusts not just supply durable asset protection however also present considerable tax obligation deferral possibilities. By placing your assets in an overseas Trust, you can potentially delay tax obligations on revenue and resources gains till you withdraw those funds. This technique allows your investments to expand without prompt tax obligations, optimizing your wide range over time.

Additionally, relying on the territory, you could benefit from lower tax rates or perhaps no tax obligations on particular kinds of revenue. This can provide you with a more favorable environment for your investments. Utilizing an offshore Trust can enhance your overall estate preparation strategy, allowing you to control your tax obligation direct exposure while safeguarding your properties for future generations.

Enhancing Personal Privacy and Discretion With Offshore Depends On

While lots of people seek ways to protect their assets, using overseas trust funds can substantially boost your personal privacy and discretion. By placing your possessions in an offshore Trust, you develop a layer of security against potential financial institutions, legal actions, and public examination. This structure generally guarantees that your individual info stays private, as overseas territories typically offer rigorous discretion legislations.Furthermore, the assets kept in the Trust are not publicly divulged, enabling you to handle your wealth inconspicuously. You can also manage how and when recipients access their inheritances, look at here even more protecting your objectives from prying eyes.

Furthermore, the intricate lawful frameworks of overseas counts on can deter those trying to challenge or access your properties (offshore trust). Eventually, choosing an overseas Trust equips you to maintain your monetary personal privacy, supplying satisfaction as you browse your estate planning trip

Planning for Future Generations: Wide Range Transfer Techniques

As you take into consideration the privacy advantages of offshore counts on, it's similarly vital to believe about how to efficiently pass on your riches to future generations. Offshore trusts can work as effective tools for riches transfer, allowing you to dictate exactly how and when your possessions are distributed. By developing an overseas Trust, you can establish particular terms to assure that your successors receive their inheritance under problems that straighten with your values.In addition, overseas counts on typically supply tax benefits, which can aid preserve your wealth for future generations. You can structure the Trust to protect your assets from financial institutions or legal More hints claims, guaranteeing that your enjoyed ones profit from your tough job.

Usual Misconceptions About Offshore Counts On

What do you actually recognize about overseas trusts? In reality, overseas trust funds can be genuine devices for estate planning and property security for a bigger audience. By recognizing these misunderstandings, you can make enlightened decisions concerning whether an offshore Trust fits your estate preparation technique.Steps to Establishing an Offshore Trust as Component of Your Estate Strategy

Picking a Territory

Picking the ideal jurisdiction for your overseas Trust is essential, as it can substantially influence the performance of your estate strategy. Begin by researching nations with beneficial Trust regulations, tax obligation advantages, and strong property protection. In addition, think concerning the costs connected with setting up and preserving the Trust in that jurisdiction, as costs can differ significantly.Choosing a Trustee

Just how do you guarantee your overseas Trust operates efficiently and efficiently? The key hinge on choosing the appropriate trustee. You'll want someone trustworthy, experienced, and knowledgeable about the laws regulating your picked jurisdiction. Think about specialists like attorneys or monetary experts who focus on overseas trusts. They recognize the nuances of handling assets across borders and can browse prospective lawful intricacies (offshore trust).You must additionally evaluate their communication style-- ensure they're transparent and responsive. Evaluate their charges upfront to stay clear of shocks later on. It's wise to evaluate their track record with other clients. A solid track record can offer you confidence that your Trust will be managed efficiently, lining up with your estate planning goals. Choose wisely, and your offshore Trust can grow.

Funding the Trust

As soon as you have actually chosen the right trustee for your overseas Trust, the next action is funding it efficiently. You'll want to transfer properties right into the depend guarantee it achieves your estate intending objectives. Start by identifying which possessions to consist of-- this could be cash, financial investments, property, or company interests. After that, talk to your trustee and legal advisor to establish the very best method for transferring these assets.Bear in click for more info mind the tax ramifications and the policies of the overseas jurisdiction. Make particular to document each transfer effectively to maintain openness and follow lawful requirements. When moneyed, your offshore Trust can provide the benefits you look for, such as asset defense and tax obligation efficiency, boosting your general estate planning approach.

Frequently Asked Concerns

What Is the Difference Between an Offshore Trust and a Residential Trust?

An offshore Trust's properties are held outside your home country, providing privacy and potential tax advantages. On the other hand, a domestic Trust runs within your country's laws, typically lacking the same level of possession security and privacy.Can I Manage My Offshore Trust Properties Straight?

You can not handle your overseas Trust properties directly due to legal constraints. Rather, a trustee supervises those properties, making sure compliance with guidelines and securing your passions while you take advantage of the Trust's benefits.

Are Offshore Trusts Legal in My Country?

Yes, overseas counts on are lawful in numerous nations, but guidelines differ. You'll need to research your country's regulations or consult a legal specialist to assure compliance and comprehend any kind of tax obligation implications involved.

Just how much Does It Cost to Establish up an Offshore Trust?

Establishing an overseas Trust typically sets you back between $5,000 and $20,000, relying on the complexity and jurisdiction. You'll want to seek advice from a legal specialist to obtain a precise estimate for your certain needs.If I Move Nations?, what Happens to My Offshore Trust.

If you move countries, your offshore Trust's tax obligation implications and legal standing may transform. You'll need to speak with specialists in both jurisdictions to ensure conformity and make required modifications to keep its advantages and protections.

Final thought

Incorporating an overseas Trust into your estate preparation can be a game-changer. Do not let misunderstandings hold you back; with the best assistance, you can develop an overseas Trust that absolutely shields your heritage.Primarily, an overseas Trust is a lawful setup where you move your possessions to a count on established in a foreign territory. In the occasion of legal conflicts, having possessions held in an offshore Trust can make complex attempts to seize those properties, as it's even more challenging for financial institutions to browse foreign legislations. Using an overseas Trust can boost your general estate planning approach, permitting you to manage your tax obligation exposure while safeguarding your assets for future generations.

When funded, your overseas Trust can give the advantages you seek, such as property security and tax obligation effectiveness, enhancing your total estate planning approach.

What Is the Distinction Between an Offshore Trust and a Domestic Trust?

Report this wiki page